Mentioning Sequoia Capital, everyone should be familiar with it, Alibaba, Public Comment Network, Debon Logistics, DJI Dajiang Innovation, Gathering Network, Gaode Software, Huada Gene, Today Headlines, Jingdong, Jumeiyou, Beauty, Beauty Mission Network, Mo Mo, Qihoo 360, Wanda Cinema, Vipshop, Sina.com, Palm Technology, Zhongtong Express... From shopping, finance, finance, to takeaway, navigation, watching movies, these Behind the giants of various industries, there is the shadow of Sequoia Capital.

According to publicly disclosed information statistics, Sequoia China's investment in the past three years is still very fast. Since 2015, 263 investments have been made, of which 135 have been invested in 2015. Sequoia China has performed so well, so what about Sequoia’s overseas record? The Prospective Industry Research Institute has compiled 58 investments made by Sequoia Overseas since 2017, with a total investment of 3.246 billion US dollars in 13 countries and 13 fields.

Analysis of the scale of overseas investment of Sequoia Capital in 2017

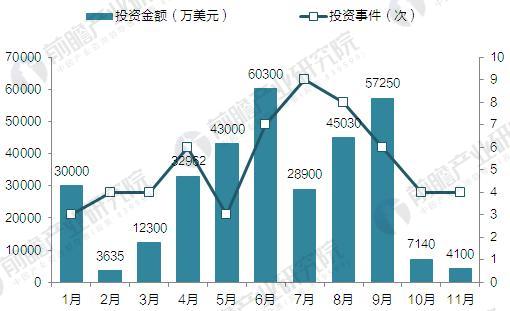

From January to November 2017, Sequoia Overseas made a total of 58 investments of US$3.246 billion, of which the investment amount in June and September exceeded US$500 million; the most investment events in July, a total of 9 Investment, but due to the low single investment amount (except for a strategic investment of 233 million US dollars in medical and health fields, the single investment amount of other investment events is less than 20 million US dollars, there are 6 million dollar investment In July, the investment amount was only 289 million US dollars; in early November, Sequoia launched 4 investments overseas, all of which were in the order of 10 million US dollars.

Chart 1: Analysis of Sequoia Capital's overseas investment scale from January to November 2017 (unit: times, 10,000 USD)

Analysis of the scale of overseas investment of Sequoia Capital from January to November 2017 (unit: times, 10,000 USD)

Source: Prospective Industry Research Institute

Regional Distribution of Sequoia Capital Overseas Investment in 2017

According to the data from the Prospective Industry Research Institute, Sequoia’s most popular overseas investment companies are mainly from the United States and India. Since 2017, there have been 32 and 19 investment events in these two countries, respectively, amounting to US$ 2.283 billion. 638 million US dollars, one is the world's economic leader, and the other is the fastest-growing emerging economy. It is not surprising that it is favored by capital.

Chart 2: Analysis of Sequoia Capital's overseas investment from January to November 2017 (unit: times, 10,000 USD)

Regional Analysis of Sequoia Capital Overseas Investment from January to November 2017 (Unit: Times, US$ 10,000)

Source: Prospective Industry Research Institute

2017 Sequoia Capital Overseas Investment Round Analysis

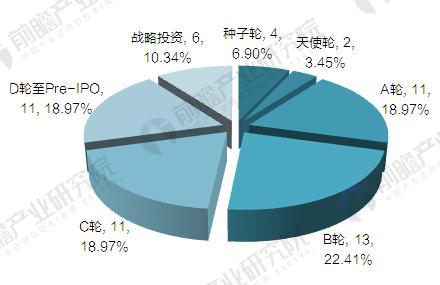

From the investment rounds from January to November 2017, Sequoia has invested the most in the B round, including 13 in the B+ round, accounting for 22.41%; A, C and D to Pre - The proportion of IPO investment is basically the same, and they have invested 11 times.

In addition, Sequoia's overseas investment in angel wheel and seed round totaled more than 10%, which is due to the difficulty of obtaining the project (the unicorn is decreasing, Google, Cisco, Oracle level is more late). As the size of the fund increases and the layout of investment rounds is extended, it is possible to screen a wider range of quality projects to ensure the fund's investment performance and return rate.

Figure 3: Analysis of Sequoia Capital's overseas investment rounds from January to November 2017 (unit: %)

Analysis of Sequoia Capital's overseas investment rounds from January to November 2017 (unit: %)

Source: Prospective Industry Research Institute

Analysis of Sequoia Capital's Overseas Investment in 2017

The entrepreneurial project in the field of “enterprise services†is worthy of being a fragrant scent. It is consistent with Sequoia China and Jingwei China. The number of projects invested by Sequoia Overseas in this field is the highest, with 20 in January-November 2017; “Healthy Health†is a cyclical industry that never declines. It is also a traditional advantage area of ​​Sequoia. Since 2017, there have been 8 investments, ranking second in its investment category.

Following the corporate services and medical health, there are 8, 6, 5, 5, 4, and 3 circuits for local life, tools, finance, and tourism.

Figure 4: Distribution of Sequoia Capital's overseas investment in January-November 2017

Source: Prospective Industry Research Institute

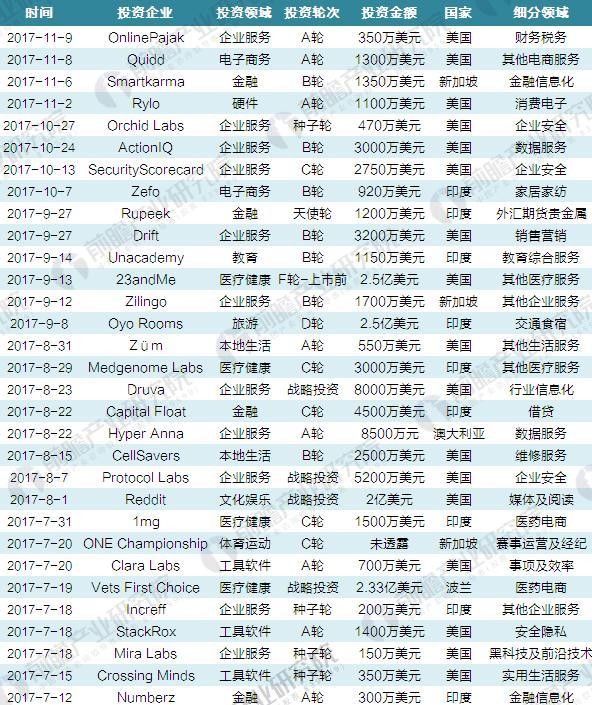

Attachment: 2017 Sequoia Capital Overseas Investment Event Summary

Exhibit 5: Summary of Sequoia Capital Overseas Investment Events from January to November 2017

Fruits And Vegetables,Fresh Fruits And Vegetables,Fresh Fruit And Veggies,Fresh Vegetables

Xi'an Gawen Biotechnology Co., Ltd , https://www.seoagolyn.com